You may be able to negotiate your medical bill with the healthcare provider's billing office to lower your costs.

Jennifer Chesak is a medical journalist for several national publications, a writing instructor, and a freelance book editor. She earned her Master of Science in journalism from Northwestern's Medill. She's also the managing editor for the literary magazine, Shift. 5 Para Monitor Parameters

Learning how to negotiate your medical bills may help lower your healthcare costs. Ask the billing office about possible errors on your medical bill or a reduced cost. You may consider appealing your insurer's decision, as well.

Start by carefully reviewing your explanation of benefits (EOB) and medical bill. Contact the healthcare provider's billing office if you notice errors, like charges for services you did not receive or duplicate charges.

Healthcare providers' billing offices are used to negotiating. Do not hesitate to ask for a reduced fee if a medical bill is too high for you or your family. Other options include applying for Medicaid if you are eligible or asking for a payment plan if you cannot get a reduced cost.

Read on to learn how to review and negotiate your medical bills and what to do if you cannot lower your balance.

You do not want to pay any part of your medical bill until you have carefully reviewed it and completed your negotiations. Plan to negotiate sooner rather than later.

Of note: Medical debt is treated differently than other types of debt. The three major credit reporting agencies only report nonpayment on medical bill information after one year.

You will receive an EOB before getting a medical bill. An EOB provides information about the cost of your services, including how much your health insurance covers and what you can expect to pay.

You can use your EOB to see your services, such as annual visits, lab tests, and screenings. An EOB will list the date of each service and the total cost of your care.

There are different types of charges on an EOB, including:

Remark codes are two- or three-character codes that explain more about the costs of your services. You can find a description of each remark code at the bottom of your EOB.

An EOB will include a claim number that you can use for reference if you call your health plan with questions about your medical bill.

Medical bills include information about you, the healthcare provider billing you, your services, and the dates of those services. Check to make sure all of that information is correct. Contact the healthcare provider’s billing office if any information seems incorrect or unfamiliar.

Your medical bill will include the total cost of your care, including what your insurer paid and what you are responsible for. Double-check that the charges of your medical bill match those listed on your EOB.

You will use an account number provided on your medical bill to pay your balance. You can give the account number to the billing office if you have concerns or questions about your bill.

"The first step when negotiating medical bills is to ensure there aren't any mistakes," Andrew Latham, a certified personal finance counselor and managing editor for SuperMoney, told Health. Call the billing office and ask them to recode and re-bill your insurer if you notice an error.

You can double-check that what you owe is accurate by scanning your medical bill for errors.

Use these tips to check for possible errors:

Ask the billing office for an itemized list of costs for each service you received. You can use the detailed medical bill to compare further with the charges listed on your EOB.

You can search online for information about the medical billing codes listed on your itemized medical bill. These codes describe your health conditions and any services and supplies you have received.

Enter the code and "medical billing code" in a search engine to view a description. Tell the billing office if the description does not match your services.

See if you qualify for Medicaid if you do not have and cannot afford health insurance. Medicaid is a program that provides free or low-cost medical coverage to people with low income, older adults, pregnant people, and those with disabilities.

In some states, Medicaid coverage works retroactively. Medicaid may pay for medical bills incurred for the past three months. Be sure to check what is allowed in your particular state.

You must meet the following requirements to be eligible for Medicaid:

Additional Medicaid eligibility requirements vary between states.

Reach out to the billing office to ask for a reduced fee. You can usually find their phone number on your bill.

"Ask if you qualify for charity care or financial assistance programs," said Latham. "Just asking for this can often cut your debt in half. It is worth noting that all nonprofit hospitals are legally required to have these programs, and many for-profit hospitals have them, also."

Have a recent tax return handy when you call. The billing office may decide on a reduced fee based on your income level.

"Even if your income is too high to qualify for charity care, you can still get a reduction of your bill if you can show the medical bills are causing you financial hardship," added Latham.

Research the average cost of your procedure in your state. Healthcare Bluebook and Healthcare Cost and Utilization Project provide data on the average price of several medical services.

"Use that information to negotiate a reduction if you are being overcharged," advised Latham.

You might consider appealing a claim with your insurer if you have health insurance and cannot afford the amount due.

Under the Affordable Care Act (ACA), you can appeal if your insurer does not pay for your services. Your insurer must provide information on how to file an appeal.

You can appeal a claim in two ways: an internal or external appeal. In an internal appeal, your insurer will thoroughly review their decision.

In contrast, you can ask a third party to lead the review in an external appeal. Your insurer must pay the cost of an external appeal. Your state cannot legally charge you more than a nominal fee for an external appeal.

Reach out to a patient advocacy group if the billing office cannot lower a charge to a rate acceptable to your budget. Patient advocacy groups often have financial assistance resources and programs that help people with financial burdens.

In the United States, healthcare is expensive. What you owe may cause financial stress even if the billing office reduces your bill. In that case, consider negotiating a payment plan. Ask for a payment plan directly with the healthcare provider.

"If you have medical bills you can't afford, don't put them on your credit card," said Latham. "You will always get lower interest rates when you negotiate directly with the healthcare provider."

In many cases, hospital and clinic bills are interest-free. A credit card can charge you extra money in interest. You will pay even more for your bill in the long run if you charge your balance to a credit card.

Negotiate with the billing office until they offer you a monthly payment in an amount you can afford without stretching your budget.

Always prioritize other major bills like car payments, rent or mortgage, and utilities over a medical bill. Not paying your rent or mortgage may result in an eviction or foreclosure. In contrast, nonpayment of a medical bill will not result in an immediate negative consequence.

Do not panic if your medical bill has already gone to collections. You can negotiate with a creditor for an interest-free or low-interest payment plan with affordable monthly installments. Do not pay a creditor with a high-interest credit card to get out from underneath the debt.

Thinking about that upcoming medical bill may be stressful after any procedure, hospital stay, or appointment. Remain calm, and chip away at it bit by bit.

There are resources, like advocacy groups and Medicaid, that can help you pay off debt. Keep in mind that you do not have to pay the bill right away. Take the time to double-check for any errors on your bill.

Centers for Medicare & Medicaid Services. Check your medical bill for errors.

National Consumer Law Center. Guide to reducing hospital bills for lower-income patients.

Centers for Medicare & Medicaid Services. Appealing health plan decisions.

Consumer Financial Protection Bureau. Paid and low-balance medical collections on consumer credit reports.

Centers for Medicare & Medicaid Services. How to read an explanation of benefits.

Centers for Medicare & Medicaid Services. No surprises: How do I read my medical bill?.

Centers for Medicare & Medicaid Services. Medicaid.

Department of Health and Human Services. Cancellations & appeals.

Centers for Medicare & Medicaid Services. Find a patient advocate.

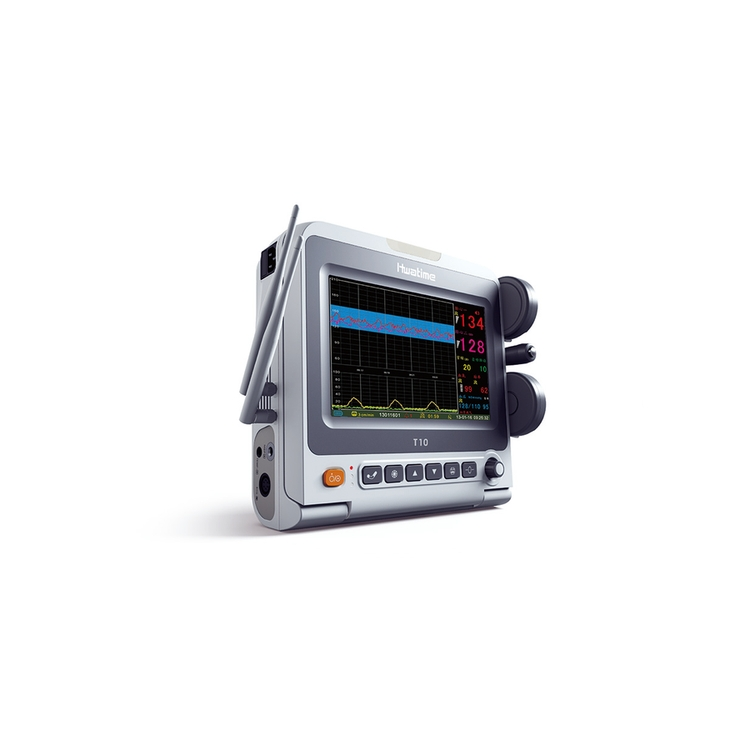

China Nibp Standard Model Vital Signs Monitor By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.