It All Connects at NADA '24

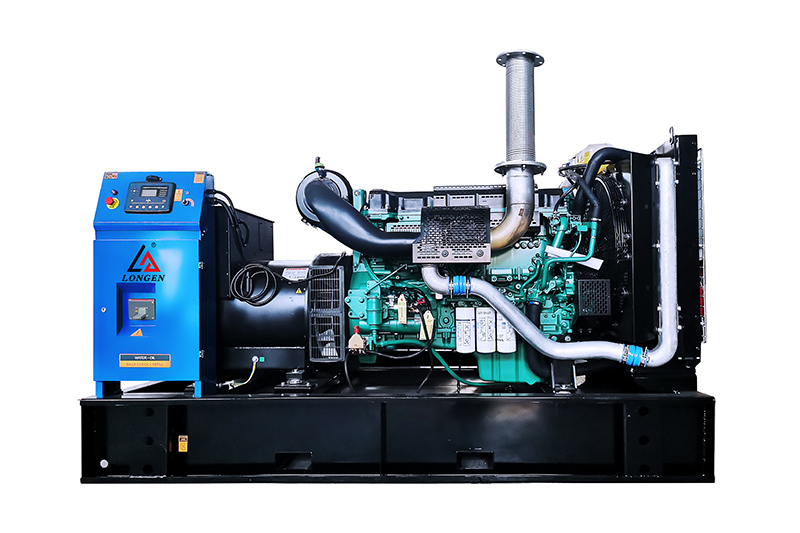

This week, the National Automobile Dealers Association is hosting its annual convention in Las Vegas, showcasing the latest thinking and innovations from across the auto industry. Dealers are always interested to hear the latest thinking from their respective OEM executives at the make meetings. I suspect the OEMs’ message will drastically differ from the past few years. Standby Power Station

In 2019, General Motors CEO Mary Barra made headlines when she said, “In the next five years, we’ll see more change than we have in the past 50 years.” Not long after, the global COVID-19 pandemic hit, and the pace of change in the industry was so rapid it looked like Mary was prescient with her prediction.

By 2021, demand for new vehicles far exceeded supply for the first time in memory, and car buyers were thrilled to pay full sticker! Car companies claimed they learned a valuable lesson from past sins: over-production, significant fleet volumes, and high incentives. At this exact moment, many automakers began spending billions to construct massive new electric vehicle (EV) production facilities. The future would be 100% electric; it was only a matter of time. And lastly, we watched the meteoric rise of online auto retailers like Carvana, who claimed they would eventually make brick-and-mortar car dealerships obsolete.

The message at this week’s NADA convention is likely to be that disciplined production, the rise of EVs, and online retailing will all be minor evolutions to the industry versus significant revolutions.

The gravitational forces of industry norms will be on full display in 2024.

Last year, new-vehicle inventories increased by 56%, propelling the industry to 15.6 million total unit sales, very close to pre-pandemic levels. Fleet volumes increased by 30% and are heading back towards historical norms. Incentives increased from 2% of the average transaction price (ATP) to more than 5%, which is still well below the norm but rapidly increasing. These are all signs that the automaker’s grand plans of maintaining tight inventories are not going as promised. Cox Automotive reports the new-vehicle days’ supply at the end of December was 70, which is also very close to historical norms.

Although EV sales reached new all-time highs in 2023 with a 7.6% market share and eclipsed 1 million sales for the first time, it is becoming increasingly clear that EVs will not revolutionize the industry in the near term as many expected. EV sales gains were driven by unprecedented discounting, with the EV market leader, Tesla, dropping prices by over 25% on popular models in 2023. If Tesla’s price reductions were treated like an incentive, their incentive as a percentage of ATP would be 35% – 7x higher than the industry average.

Meanwhile, as the legacy car companies try to break into the EV game, they face the brutal reality of rising EV inventories, declining consumer demand, and dreadful margins. Analysts estimate Ford lost $36,000 per EV sold in Q3 of 2023. The CFO of Mercedes-Benz Group, Harald Wilhelm, recently commented, “I can hardly imagine the current status quo is fully sustainable for anybody.” Ford and others have begun walking back their EV ambitions and shifting their strategy towards ICE and hybrids.

Online retailers, like Carvana and Vroom, were trailblazers poised to change how Americans bought cars. During the pandemic, their sales and stock prices took off like a rocket. In response, publicly traded auto retailers like Lithia and AutoNation developed their own online retailing experiences. Despite the massive investments and efforts to support online transactions, which some consumers appreciate, the most recent Cox Automotive Car Buyer Journey report shows that 93% of consumers purchased vehicles inside showrooms, and most are happy with their “old school” showroom experience. In-dealership sales experience for new-vehicle buyers improved from 64% highly satisfied in 2018 to near an all-time high in 2023 at 79%.

This past week, online retailer Vroom announced they are winding down operations. In October 2023, online retailer Shift Technologies suffered the same fate. These are more examples of the industry’s gravitational forces pulling things back toward historical norms. Interestingly, new upstart EV companies like Fisker and VinFast will be at NADA this week and are working to establish unique dealer networks with brick-and-mortar locations.

Bill Gates once commented, “We always overestimate the pace of change in the next two years and underestimate the pace of change in the next 10.” This sentiment perfectly captures the current state of the auto industry. The car business’s fundamentals remain intact despite the never-ending wave of disrupters, innovations, and new ownership concepts. Car companies that focus on building the best products customers want, coupled with franchise dealers providing outstanding service, will be a winning formula for the foreseeable future.

With the benefit of perfect hindsight, maybe Mary Barra should have said, “In the next five years, it is going to be a wild ride, but things are not going to change as much as you might think.”

Marine Diesel Generator As Senior Director of New Car Solutions at Cox Automotive, Brian Finkelmeyer is responsible for vAuto/Cox Automotive’s New Car Strategy, including vAuto’s Conquest Inventory Management Solution and the Cox Automotive Rates and Incentives Business. Finkelmeyer works across Cox Automotive’s various businesses to develop new data insights which help our OEM and Dealer partners fully capitalize on their market opportunities.